#ศาสตร์เกษตรดินปุ๋ย : ขอบคุณแหล่งข้อมูล : หนังสือพิมพ์ The Nation.

Car sales are inching forward.

Though new-vehicle sales are down 47% year-over-year, and rental, commercial, and government fleet purchases have fallen 70% over the same period, too, the auto industry has enjoyed small amount of good news. Average incentive spending reached $4,296 per vehicle in April, according to Cox Automotive, up 7% from March and up 26% year-over-year. Sales of classic cars are booming. Factories across Europe and the U.S. have begun to reopen.

So have dealerships, though they are reeling from the loss of 265,000 jobs, according to Cox Automotive. Take Porsche Beverly Hills, where Sascha Glaeser works as director of customer experience and VIP sales. “We opened again on Friday, and customers are coming into the dealership,” he said by phone. “For me, I’m trying to do everything from home. When I do go in, we have masks on. We try to keep as much distance as possible.”

The outbreak has significantly changed how we think about-and shop for-the cars in our lives. While some changes are temporary, others are most likely permanent.

To better learn how the car-buying experience will evolve through covid-19-and how best to navigate it-I spoke with experts from research firms, car dealerships, and even our own Bloomberg Automotive Intelligence team. They highlighted a host of issues that will factor in to the new world of car buying, including e-commerce, independent mechanics’ shops, and strict franchise laws. Below are their answers to the most pressing questions about the future of acquiring vehicles.

– Will social distancing kill the car dealership?

The shorter answer is no, it won’t. But it has sped up changes that were already in motion before the covid-19 pandemic hit.

“We know that consumers will continue to be concerned about social distancing,” says Stephanie Brinley, principal automotive analyst at research firm IHS Markit. “But what we really see is that there were trends toward making car buying an easier process already happening before we started going into [the pandemic].”

The old-fashioned handshake deal will be dead. But the prevalence of smaller showrooms, tactical, more localized marketing, pre-approved financing, and online sales and insurance transactions is likely to grow.

Jack Gillis, executive director of the Consumer Federation of America, says social distancing is quickly forcing car dealers to alter their entire sales strategy. Some dealers are changing compensation plans, for instance, so sales representatives get paid for how many cars they sell, not necessarily the value sold. This removes a lot of pressure on the sales floor-for everyone.

“One of the biggest challenges for a consumer when buying a car is matching wits with a seasoned professional in the showroom-this is a person trained to get as much money as they can for each car,” he says. “These are trained negotiators who do this, day in and day out. Consumers are like lambs being led in to slaughter when we go into a showroom.”

In many cases, Gillis says, the car-buying process becomes so frustrating and anxiety-laden that consumers give up.

“By the end of it, we’ll do anything to just get out of there and just get our car,” he says. “People sign on the bottom line for things they don’t really need-like rust proofing and special mats and paint sealant-just to get away.”

Coronavirus will change this by winnowing out the worst dealerships and demanding efficiency and better service in others. The good news for consumers, he says, is that we won’t be going back to this condition as normal-ever.

– Well, how good are dealerships at doing socially distanced transactions?

It depends on where you are. Some dealerships are better at it than others. They’ve got their work cut out for them: According to Cox Automotive, some 60% of consumers would rather not visit a car dealership at all.

“Are car dealerships future-proof? No, no they’re not,” says Glaeser.

Plastic wraps on steering wheels and seats, driveway drop-offs for test drives, and personalized new-car deliveries are all on the table for dealerships motivated to support safety-sensitive customers. The points of contact between consumers and salespeople should be minimized, with one person, rather than two or three or five, devoted to each customer. There will be much more one-one-one attention for customers who engage with sales people, especially at higher-end brands, predicts Glaeser. (The business case for that is simple: Get a consumer in a cozy, comfortable, safe, and intimate environment, and they’re more likely to spend money.) In Los Angeles, Glaeser is doing selective, masked one-on-one test drives with customers from their homes in the Pacific Palisades.

“The best dealers we see are taking social distancing very seriously,” says Jeremy Anspach, chief executive officer of Purecars, an automotive digital marketing firm. “When you think about all the cars in the showroom and the spacing, compared to a box retailer or a grocery store, the idea of social distancing is quite easy.”

That said, there will be culling. Some automakers have too many dealerships dotting the country; this has led to some splintering business profits that will be exacerbated during and after the pandemic, says Kevin Tynan, director of automotive research for Bloomberg Intelligence.

Exhibit A: Fiat Chrysler has 10,271 dealerships in the U.S. while Toyota has 1,400, according to Bloomberg Intelligence. Last year, the average Chrysler dealer sold 656 units, while the average Toyota dealer sold 1,700. Assuming an industry average of 5% margin profit for each sale, it’s easy to see which dealers fared better.

“Toyota doesn’t have the footprint, but they have a much healthier base because [each dealer] is getting theirs,” explains Tynan. “The domestic guys look at the numbers and would likely say we have too many of these damn things. They’re eating each other. Politically, of course, they won’t say, ‘We would just love to kill some dealerships.'”

The pandemic may do it for them.

– Is this the death of the test-drive?

Not yet. Historically, at most dealerships, the rule was that you had to take the car out with a sales representative. All the technology in modern cars made this essential; it’s better to learn how to use the Bluetooth from a person than an app. Special friends of the dealership and VIP clients could take the car for a spin alone, after handing over driver’s license and insurance information.

Expect to see more of that post-covid-19.

“Many of the problems that a consumer has with a car could be sussed out with one good, long test drive-preferably without the sales rep,” says Gillis. “You’ve got to kick the tires to make sure you like the car. That concept of touching it, feeling it, looking at it, sitting in it, driving it is very ingrained in the way we buy cars.”

The test drive should last at least an hour. Park it in your driveway, and pull out. Steer it into your garage. Take it on the highway. Drive it on your normal errands route. You’ll end up observing the things that could become problems later, such as blind spots, ambient road noise at high or low speeds, a too-small (or too large) trunk. You may just decide you don’t like the car’s color in your driveway.

– What about online sales? Will those increase?

Yes. Online car sales in 2019 made up 10% to 15% of the total U.S. vehicle market, according to research firm Autopia. But if you listen to the experts, buying a car online won’t be the first choice for most car shoppers, even after covid-19.

Dealers are likely to update and improve their websites. And they’ll probably respond to emailed inquiries faster. But the average transaction price of a new car is $35,000, and $21,000 for a used car. It’s still the largest payment you’re likely to make for something other than your home. For most people, it’s “inconceivable” to purchase something of that value without seeing it first, says Tynan.

“I think e-commerce will go up, but it was going up anyway,” he says, adding that this also has to do with getting the best deal possible, which is less likely via impersonal transaction online. (Online sales were less than 10% of total domestic car sales just three years ago.) “We may do some more online research first, but no dealer is going to give you their best deal through email. I just don’t see that happening.”

Consumers can use that to advantage. Do even more research online, and cross-shop from dealer to dealer before you head to the dealership for that (socially distanced) test drive.

“There will be tremendous competition over the next six months because the industry is suffering,” Gillis says. “Dealers have a huge incentive to offer the very best prices. And if you combine that incentive with your ability to shop online from dealer to dealer, you can end up getting a great car and a great value.”

That said, do companies already doing online sales, such as Carvana, have an edge in the new generation of car buying?

Yes and no.

When it debuted in 2013, Carvana leapfrogged the franchised dealer by allowing consumers to buy cars online, which forced franchised dealers to elevate service and allow customers to complete transactions in any number of ways. In 2018 Carvana sold 100,000 cars; last year it sold 177,549. (Revenue in 2019 reached $3.94 billion, an increase of 101%, year-over-year.) Company chief Ernie Garcia has said he thinks annual sales can reach 2 million vehicles.

The company’s current and best advantage is its centralized inventory and its relatively easy seven-day-return policy. Most local car dealerships can’t compete with that from a logistical point alone. But Carvana’s business model is difficult to scale to a truly national scale, and this will keep it from totally replacing traditional dealers, which are too locally focused to sell online across a national platform.

“It’s a niche thing,” Tynan says.

If you do decide buy a car online, the most essential thing you must do is fully understand the return policy.

– Will there be a different future for the purchase of a luxury car?

Yes. The new normal for car buying may very well fall along the line between wealthy and average.

“The Carvana-type of online buyer is that kind of person who buys on Amazon. It’s a digital transaction,” says Anspach. The franchise dealer is still the trusted choice of consumers who want an experience for a larger purchase. Such automakers as Lamborghini, Ferrari, Bentley, and Rolls-Royce have long catered to that impulse with exclusive ateliers and customization shops that are separate from dealerships.

“I envision that this type of luxurious, intimate environment could be a good model for the future,” says Glaeser. “For exclusive and high-end cars, it would be a boutique or salon that will handle customization, selection of colors and textiles and leathers, and all of that for the client. It will be very safe, very one-on-one.”

– Will consumers stop buying cars as often as they used to?

It’s likely. There may be some permanent tapering, even after the primary concerns of food, shelter, and health-which are foremost in mind during a pandemic-are allayed. The average age of the car on the road today in America is 11 years; expect that number to rise, says Gillis.

“There’s a tremendous lack of demand, not pent-up demand,” he says. “Consumers are thinking: ‘You know, maybe I really don’t need a new car right now. My car is fine, it’s running well. I’m rarely using it. I don’t feel this urgency to go out and buy a new car.'”

Not to mention that regulations require less driving, anyway. Travel on all roads and streets declined by 18.6% (50.6 billion fewer vehicle miles) for March 2020, compared with March 2019, according to the U.S. Department of Transportation. Personal travel around the country by car fell 46% year-on-year during the week ending April 17, according to Inrix surveys. We are driving far less, slashing the urgency to buy a new car.

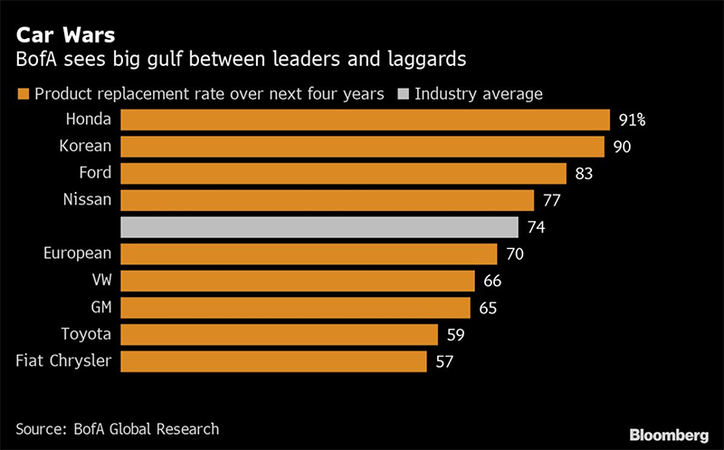

“Consumers are going to realize they don’t need to replace their cars so frequently, and we are going to become used to keeping our cars longer,” he says. “Over time, that will reduce this sort of perpetual need to replace your car every three years. Buyer behavior is going to change, so the whole industry is going to change dramatically.”

– Is home delivery going to stick around?

It depends on your dealer. But for most dealers, the time sales reps would spend dropping off and picking up cars to individual consumers’ houses for test drives or deliveries is not cost-effective.

“Margins at most dealers are under 5%, so you’re on a razor-thin margin, anyway,” Tynan says. “For used cars, the margin is about 7.5%. And the closing rate of driving a car to someone’s house for a test drive isn’t much higher than not. So how are you going to incur these additional [delivery] costs?”

On the other hand, Anspach says some post-Covid-19 dealers will be more willing than ever to service customers, however they want to be serviced.

“Whether it’s pickup and drop off-for a lot of dealers it’ll be: ‘The car will be here and running. I’ll text you when we are on our way. You don’t have to even speak to me,'” he says.

– How will the auto industry recover from this?

In a word: trucks.

“A big part of the recovery, and we did see this in April, is that from the manufacturer to the retail channel to the dealer, the key is sellable products-and sellable products are trucks,” Tynan says. “If you’re going to dig out of this, you’re going to get your best shovel. And it’s just simply trucks.”

Indeed, according to Bloomberg Intelligence, 75% of autos sold in April in the U.S. were light trucks (which includes SUVs). Hyundai, for one, has taken advantage of the numbers: By April, Hyundai had increased its truck mix by 11 percentage points over 2019, up to 54% trucks from 43% trucks, and adding such models as the Venue crossover.

“When you think about the revenue and the profit side of the business, that’s where you have to live,” says Tynan. “You want to do more with less. Volume is going to be beat up for a while, so you have to have the higher revenue contribution and the higher profit contribution. That’s just the way it’s going to be, so at the retail level, that’s the mindset: Give me trucks.”

Elsewhere, automakers must simply move forward with projects already underway.

“When people are working from home, there’s only so much you can do to help something move forward-but they’re still moving forward,” says Brinley. “The anticipation is that it’s fundamentally temporary. It’s maybe just going to be longer than we expected.”

Employees assemble a Jaguar E-Pace compact sport utility vehicle on the production line at the second phase of the Chery Jaguar Land Rover Automotive Co. plant in Changshu, China, on June 27, 2018. MUST CREDIT: Bloomberg photo by Qilai Shen.

Employees assemble a Jaguar E-Pace compact sport utility vehicle on the production line at the second phase of the Chery Jaguar Land Rover Automotive Co. plant in Changshu, China, on June 27, 2018. MUST CREDIT: Bloomberg photo by Qilai Shen.